EnviroPress Reporter

While Kuvimba Mining House (KMH) secured the crucial social license to operate its Sandawana lithium mine, the company’s leadership walked away from a recent meeting with more than just an endorsement. They left with a comprehensive, unwritten social contract to serve as the chief architect and financier of Mberengwa’s transformation from a rural district into a modern town.

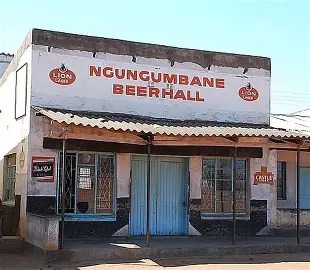

The list of “great expectations” laid out by Senator Chief Ngungumbane on behalf of 15 traditional leaders goes far beyond standard corporate social responsibility. It is a strategic mandate that effectively outsources municipal-level development to the mining firm. Beyond their existing US$100 million plan for a solar plant and US$110 million for road rehabilitation, KMH is now publicly expected to:

Become a public works authority: Tar a network of district roads, not just a single commercial artery.

Act as a water utility: Address a regional “threat to national security” by rehabilitating and building new dams and executing a district-wide borehole drilling program.

Serve as a housing developer: Manage a complex “development-induced displacement” program, constructing a new school and “ideal model homes” under intense public scrutiny.

Drive local economic policy: Restructure their entire supply chain to prioritize local businesses.

Godwin Gambiza, Sandawana’s general manager, gave a measured response, stating the firm would sit down and rank the community’s expectations. This crucial task of ranking will involve a high-stakes balancing act between immense potential and significant risk.

By fulfilling the mandate, KMH can create a stable, loyal, and self-sufficient host community, mitigating operational risks and building a powerful legacy. Turning Mberengwa into a town with banking and amenities would attract and retain skilled labour, creating a virtuous cycle.

The Risk: The costs for these large-scale public infrastructure projects are astronomical and largely unbudgeted. The company must now navigate shareholder expectations for profitability against the community’s non-negotiable terms for its cooperation.

The success of the US$56 million Sandawana revival will now be judged not just on its lithium output, but on KMH’s ability to deliver on one of the most ambitious corporate-led development plans in the nation’s history.